Step-by-Step Guide Fab Account Opening Online in 2025

Have you ever wondered how to open a bank account safely and swiftly with First Abu Dhabi Bank (FAB)? FAB streamlines and expedites the procedure whether you are a student, worker, or business owner. Thanks to online accessibility and user-friendly tools, opening an account has never been simpler.

To guarantee a smooth process, let me walk you through the necessary paperwork and eligibility requirements in a Step-by-Step Guide Fab Account Opening Online in 2025.

What is FAB, and Why Open a FAB Account?

One of the biggest and most reputable banks in the United Arab Emirates is First Abu Dhabi Bank, or FAB. It’s incredibly simple to open this bank account both online and offline. Nonetheless, there are a few things to remember, such as entering the right data and the relevant papers. In this post, we included a comprehensive guide on opening an FAB bank account.

But it’s also important to understand the role that the FAB bank plays in your day-to-day life. Secure transactions are the first and most significant factor that practically makes it possible for everyone in the United Arab Emirates, including students, employees, and business owners. FAB consistently provides a safe way to transfer money without incurring additional costs. Additionally, this bank offers widely accepted methods of bill payment and hassle-free overseas transactions.

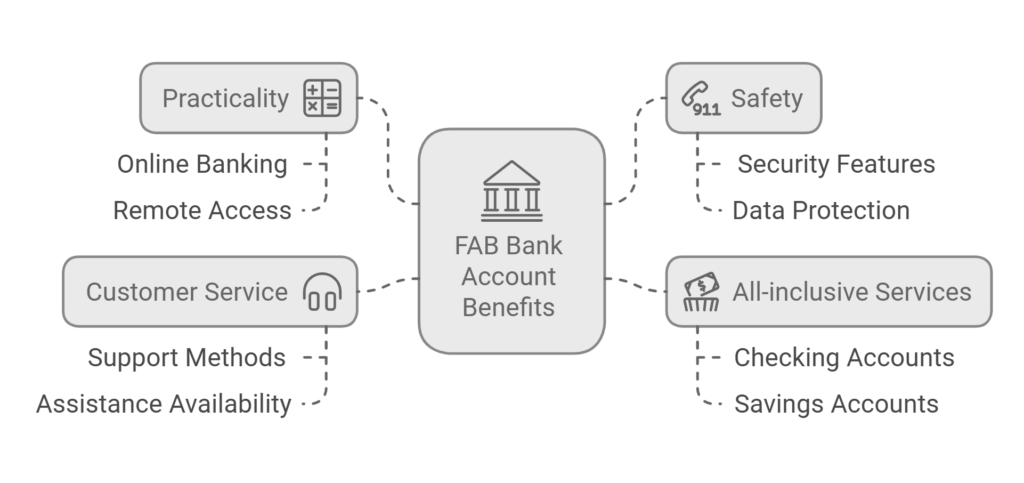

Top Benefits of Having a FAB Bank Account

One of the top banks in the United Arab Emirates for handling your money is First Abu Dhabi Bank. Additionally, this banking offers you options like credit, loans, personal and corporate accounts, and more in this dynamic nation. The following justifies the significance of selecting FAB:

Practicality

You can plan and manage your finances with FAB online banking, and you can access your account from any location.

Safety

FAB offers first-rate security features that provide you peace of mind, regardless of whether you live there or are a visitor. Additionally, it guarantees the security of your money and personal data.

All-inclusive Services

To meet your demands in this busy nation, FAB offers you a variety of services, such as checking and savings accounts.

Customer Service

First Abu Dhabi Bank provides excellent customer service across several methods. Additionally, it guarantees that you may seek assistance in the UAE when you need it.

How to Start Your FAB Account Opening Process?

As previously said, opening an FAB account is a simple process. In the UAE, there are two primary methods for opening an FAB bank account: online and offline. Below are the specifics of both of these approaches:

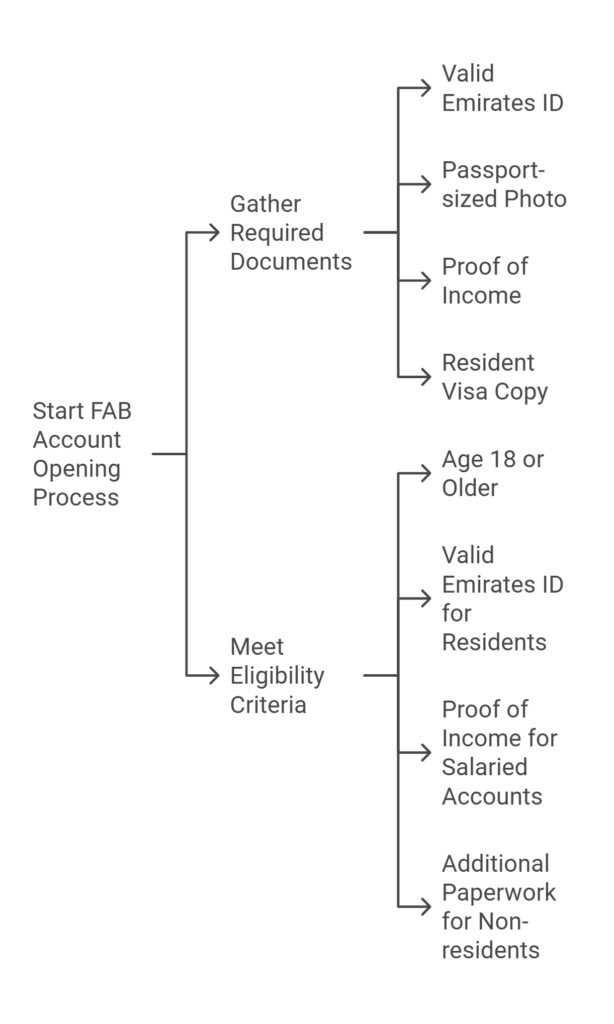

Gather Your Required Documents for FAB Bank Account Opening

- Before beginning the application, make sure you have the necessary documents available to prevent delays:

- Valid Emirates ID (both scanned and original)

- A passport-sized photo.

- Proof of income or a salary certificate (if employed).

- Copy of a resident visa (for expatriates).

- Additional paperwork could be needed for corporate or business accounts.

Eligibility Criteria for Opening an FAB Account

- The criteria that follow must be fulfilled to open an FAB account:

- Age: 18 years or older is required.

- Residents of the United Arab Emirates are required to present a valid Emirates ID.

- Income: For salaried accounts, proof of income or pay stubs are required.

- Non-residents: With extra paperwork, like international identification, they can open accounts.

How to open an FAB account online in 2024 step-by-step guide?

You can avoid long lines and paperwork by opening a bank account online, which has become a standard feature of convenience. This guide will take you step-by-step through the whole process of opening an account with First Abu Dhabi Bank (FAB), guaranteeing a simple and easy experience.

Choose the Right FAB Account Type

To meet diverse needs, FAB provides a range of account types, such as investment, current, and savings accounts. Think about the things you require from your bank account:

Resident Account

By proof of residency and presenting their Emirates ID and work information, UAE citizens can create an account. The entire process, from approval application, may be completed online and is effective.

Non-Resident Account

A passport, a visa with an entry stamp, and occasionally documentation of residency or work with an origin ID card are required of non-residents. Although the procedure is the same as for residents, extra paperwork may be needed to meet international banking standards.

Savings account

A savings account is the best if you want to generate profit on your investment.

Current Account

Current Account is ideal for monitoring your cash flow and everyday transactions.

Investment Account

An Account is Ideal if you want to make investments.

Online vs In-Branch Account Opening

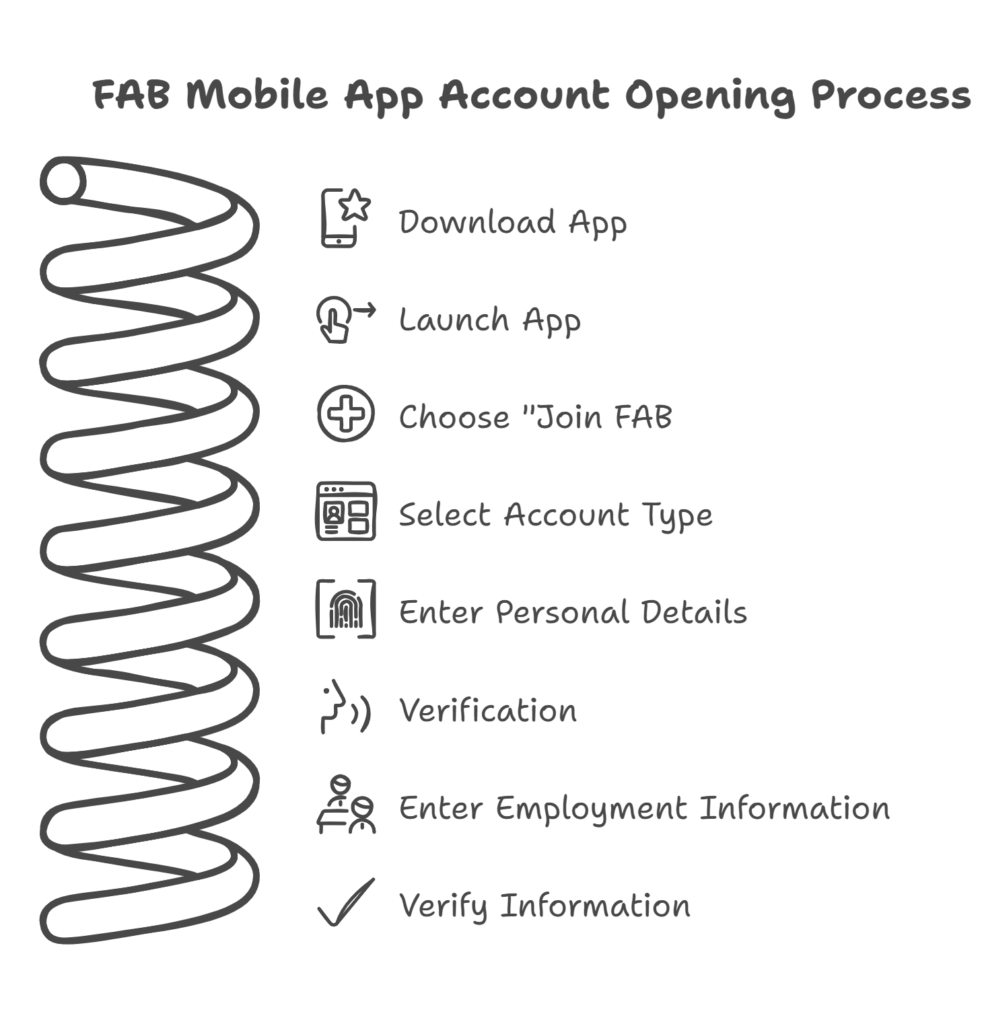

Opening account with FAB Mobile App

The FAB Mobile App offers a simple account opening process. Take these actions:

- Download the FAB Mobile App from the Apple App Store (iOS) or Google Play Store (iOS).

- Launch the app, then choose “Join FAB.”

- Choose the account: Depending on your needs, you can choose from current, savings, or hybrid account types.

- Enter personal Details: Put in your email address, phone number, and name. You will receive an OTP (One-Time Password) for verification, so be sure these are correct.

- Verification: Provide a scanned copy of your Emirates ID to confirm your identification. For an extra degree of protection, be ready to snap a selfie.

- Enter Employment Information: For correspondence, provide your employment status, salary information, and the closest FAB branch.

- Verify the accuracy of all the information you have entered, then apply.

- Receive Confirmation: You will receive your account credentials by email or SMS after being approved. Within two business days, your cheque book and debit card will arrive.

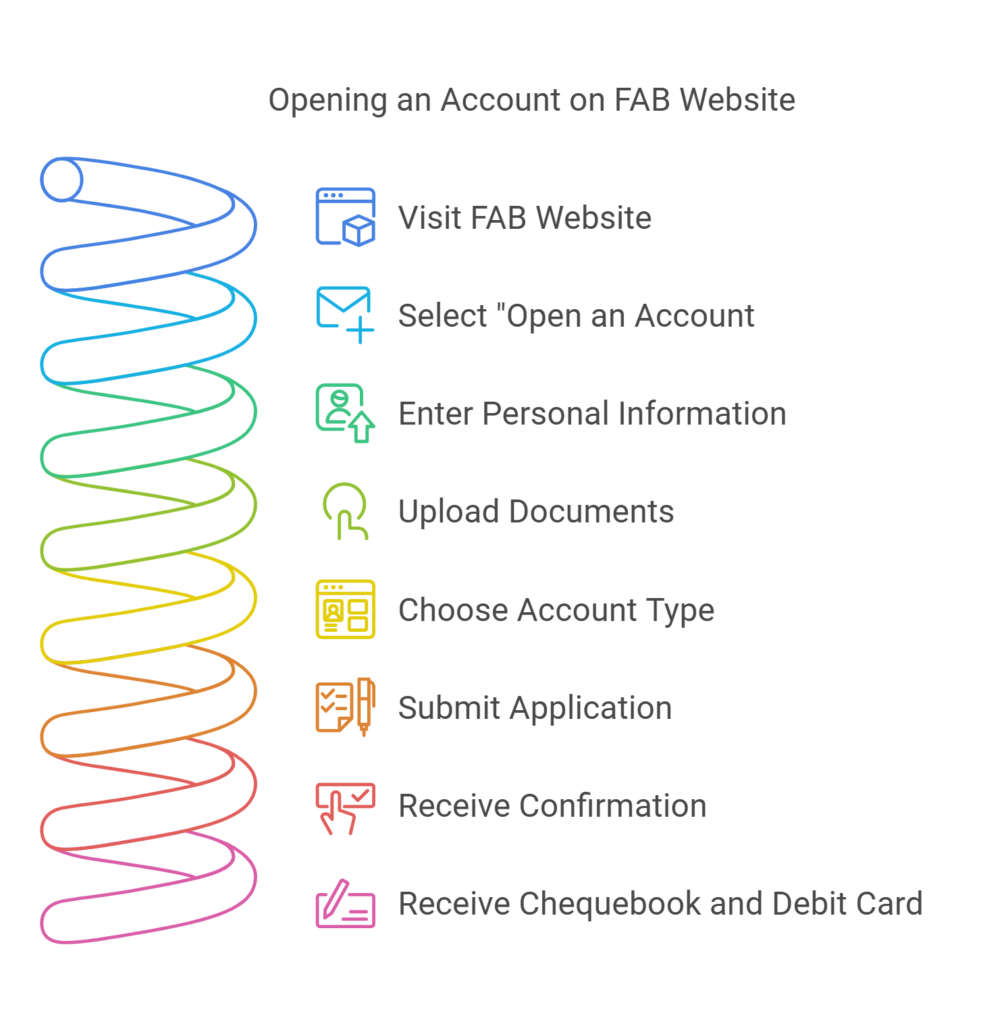

Opening an account with the FAB official website

The FAB website provides a safe method of opening an account for individuals who would rather use a browser-based method. Take these actions:

Visit the FAB website and choose the “Open an Account” option.

Enter your personal information: name, phone number, email address, and salary information, among other personal details.

Upload Documents: Include scanned copies of your Emirates ID together with other required papers, like your proof of income.

Choose the account: Depending on your interests, select a current account or a savings account.

Submit the form: Make sure all the information is correct, then apply.

Confirmation of Account: An email or SMS confirming your account acceptance will be sent to you. Your cheque book and debit card will be sent out as soon as possible.

How to Get Your FAB Bank Statement Online

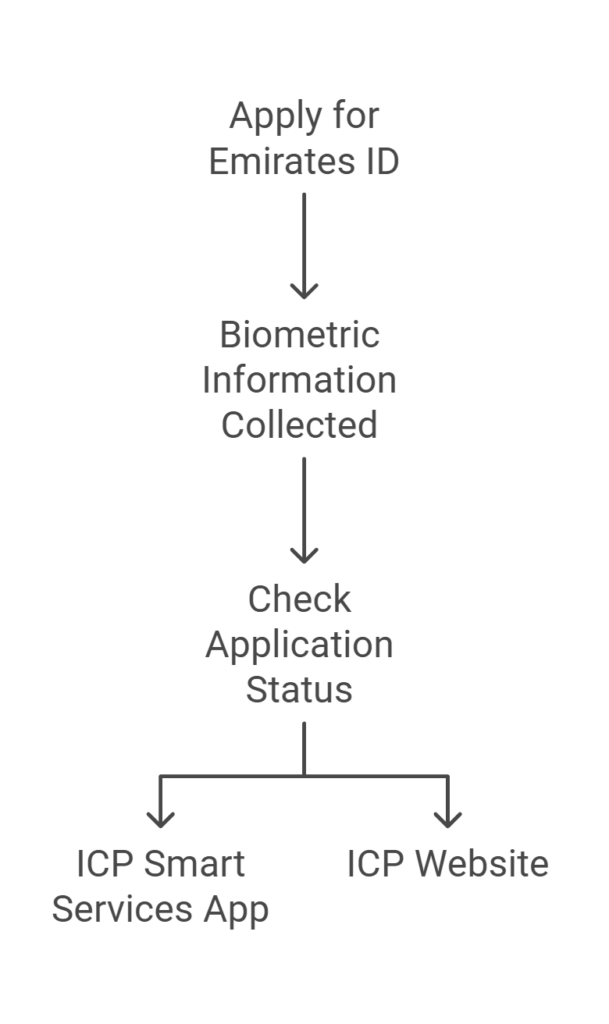

Understanding the Emirates ID Verification Process

Emirates ID verification starts by applying for an Emirates ID at an authorized center or via the ICP portal.

Biometric information is also required for verification; a picture of your face and your fingerprints will be given.

You can use the ICP Smart Services mobile app or the ICP website at icp.gov.ae to see the progress of your Emirates ID application. To check the status, enter your Emirates ID number or application registration number (PRAN).

Why OTP Verification is Important for Security?

By ensuring that a stolen username/password combination cannot be used again, the OTP feature guards against various types of identity theft. The one-time password usually changes with each login, whereas the user’s login name usually remains constant.

An OTP is generated by creating a random, difficult-to-guess string of characters using a safe technique. After that, the user receives this code by a delivery mechanism like email, SMS, or a special app. This code is invalid after the user enters it and cannot be used again for verification in the future.

By limiting access to protected resources to verified individuals or processes, authentication helps organizations maintain the security of their networks. Databases, websites, wireless networks, wireless access points, personal computers, and other network-based programs and services might all fall under this category.

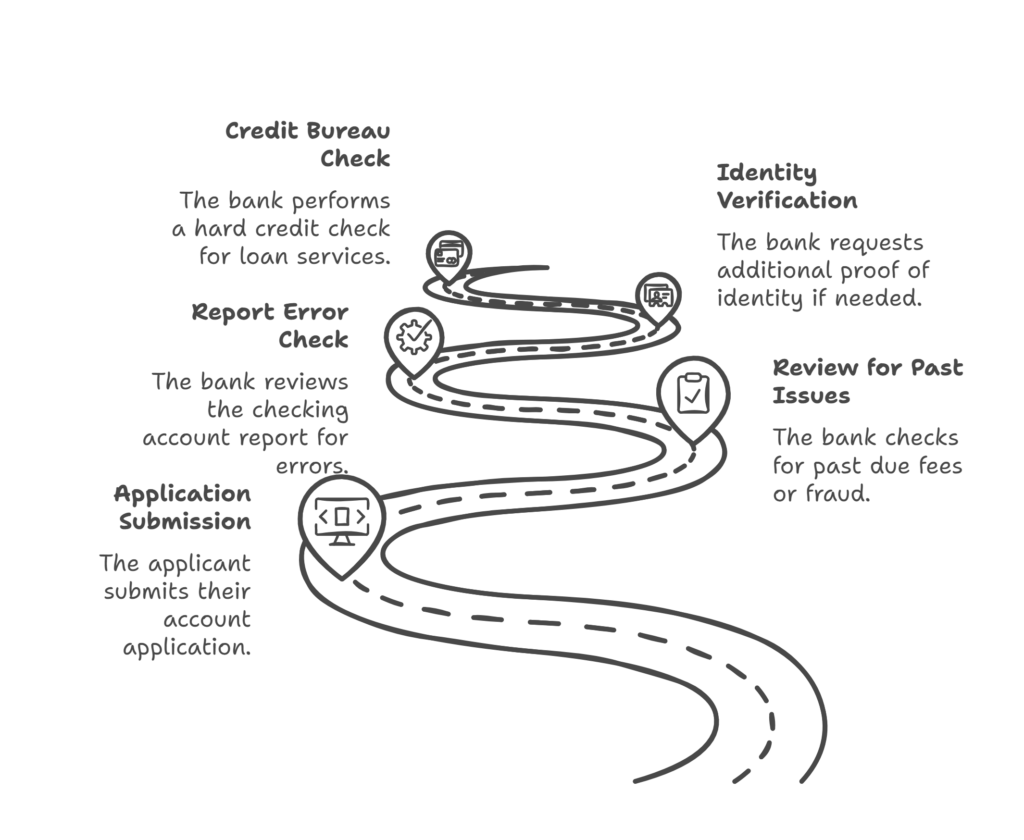

Common Issues Faced During Account Opening

Here are some common issues that you can face while opening an FAB account.

1. Past due fees, overdrafts, or even fraud

An application for a bank account may be rejected if there is a history of these problems.

2. Errors on a report for a checking account

An application may be rejected if a checking account report contains errors.

3. More proof of identity is needed

If the bank has doubts about the applicant’s identity, they may ask for more proof, such as a photo and signature.

4. Check of the credit bureau

The bank will perform a hard credit check when a new client asks banking services that include a loan. The applicant’s credit score may be lowered for a full year as a result of this check. Read More about Fab Personal Loan.

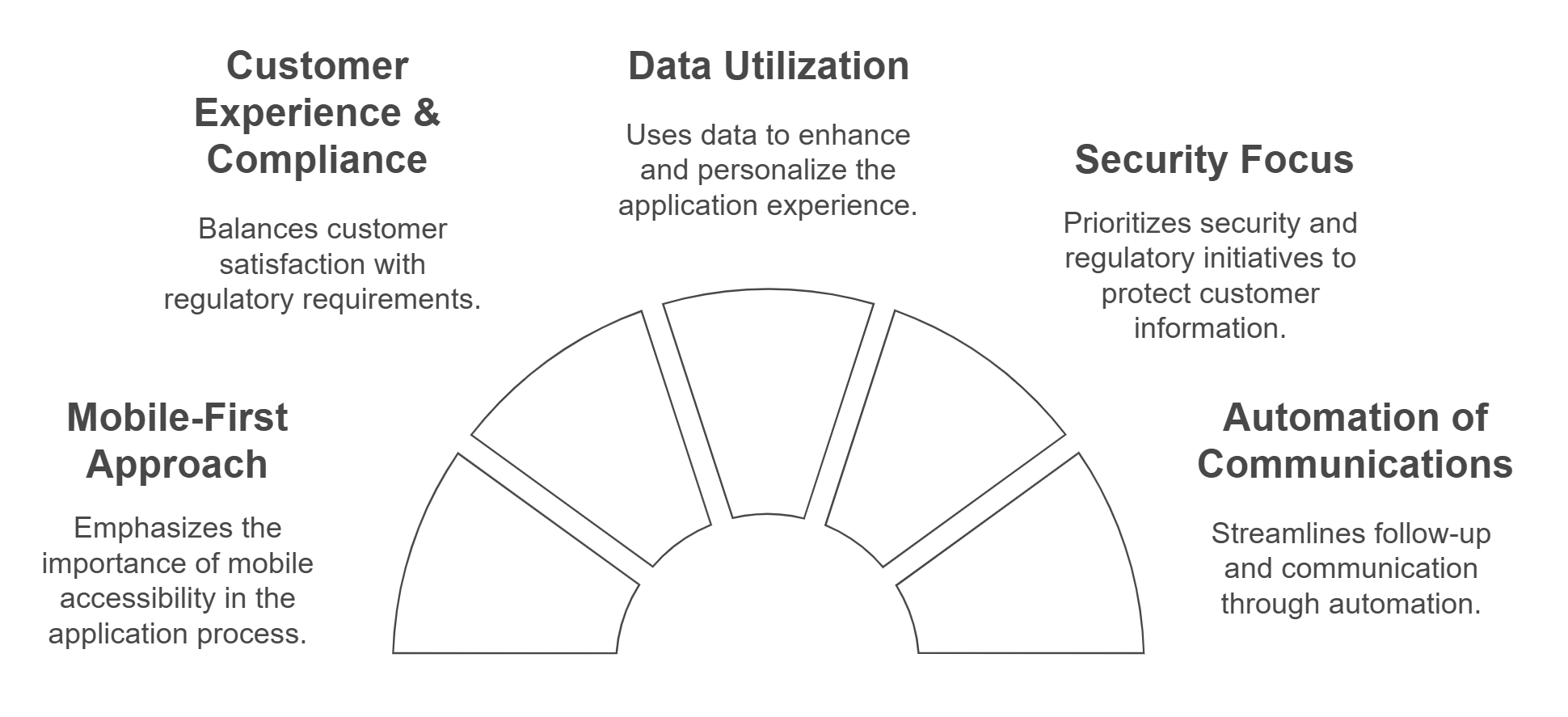

Tips to expedite the FAB Account Application Process

- Make the process of opening an account mobile-first.

- Make sure that the customer experience and compliance are carefully balanced.

- Using Data to Provide a Quicker and More Tailored Experience.

- Put a focus on security and regulatory initiatives.

- Automate Follow-Up and Customer Communications

Frequently Asked Questions

What are the eligibility criteria for opening an account at FAB Bank?

You must have a valid Emirates ID and be at least eighteen years old to create an FAB bank account online. Non-residents might have to submit more paperwork.

What documents are required for opening an FAB account?

You’ll require:

- Depending on your account type and job situation, additional documentation could be needed.

- A legitimate Emirates ID, both original and copy

- A passport-sized photo

- Evidence of income, such as a pays lip or salary certificate Copy of a resident visa (for foreign nationals)

Can non-residents open an FAB account?

Although non-residents can open an FAB bank account online, they might still need to submit additional paperwork, like proof of address and a valid passport. For specific needs, it’s best to speak with FAB directly.

Is there a minimum balance requirement to open an FAB account?

There may be minimum balance requirements for certain FAB accounts. For example, a minimum balance of AED 3,000 is required for several accounts. For the sort of account, you are interested in, it is best to review the exact terms.

How long does it take to open an account?

If all necessary documents are submitted and swiftly validated, the FAB online account opening procedure is intended to be simple and may be finished in a matter of minutes.

What kinds of accounts can I open using FAB online?

Savings accounts, current accounts, and speciality accounts like the iSave Account, which offers excellent interest rates, are among the several accounts that FAB offers that may be opened online.

How can I prove who I am when creating an online account?

A scanned copy of your Emirates ID must be uploaded as part of the online application process, and you could also be asked to snap a picture so that facial recognition can confirm your identity.