FAB Personal Loan: Minimum Salary of 2000 A Complete Guide

For those in the United Arab Emirates, particularly foreign citizens and expats seeking to satisfy their financial demands, obtaining a personal loan from First Abu Dhabi Bank (FAB) can be a terrific option. The eligibility requirements, application procedures, features, and advantages of FAB personal loans are all covered in detail in this guide, which is intended primarily for people making at least 2000 AED per year.

The minimum salary requirement for FAB personal loans

The minimum salary requirement for FAB Personal Loans means, Don’t worry if you only make AED 2,000 a month and are seeking a personal loan in the United Arab Emirates. Options are still available. AED 5,000 is the minimum salary requirement of the other banks. Since these loans are intended for those who have a minimum 2000 AED monthly salary income, they can supply them with financial solutions that satisfy their requirements.

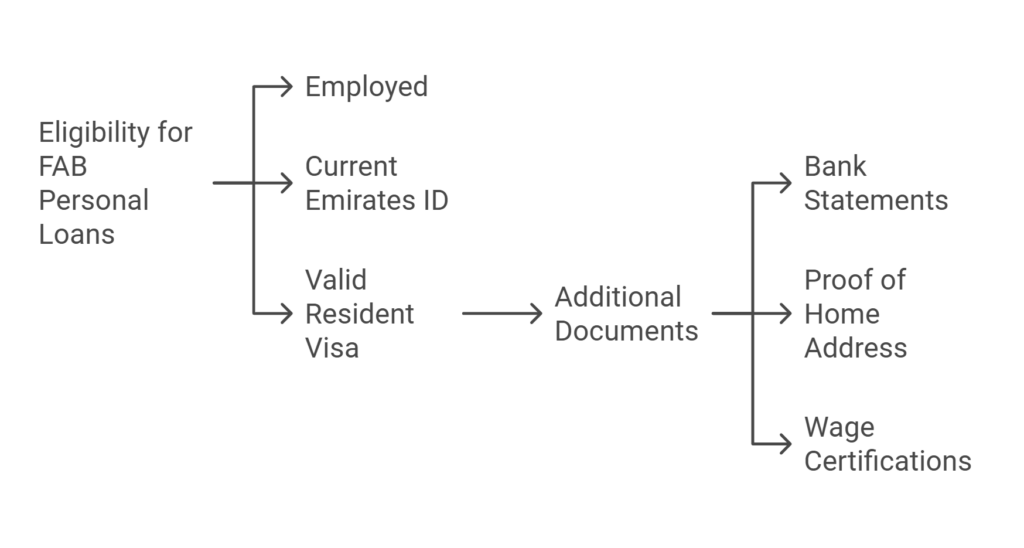

Eligibility Criteria for FAB Personal Loans in the UAE

Do you have concerns about investing much in your next projects? You don’t have to worry now. Personal loans with a minimum of 2000 AED are available from FAB. As a result, the most perplexing query that emerges is: What are the precise requirements for eligibility? We’ve talked about it below.

Employment status

You are eligible for a loan if you are employed. To apply for a loan at FAB, you must wait at least six months for your application to be approved. You must have a legitimate employer and a current Emirates ID.

Residential status

You must fulfil all basic residence requirements when you apply for a loan. To process it smoothly and hassle-free, you must have a valid resident visa. Additional documents, such as bank statements, evidence of home address, and wage certifications, may also be requested by the FAB.

To be eligible for a FAB personal loan, applicants must meet certain criteria

| Criteria | Details |

| Minimum Salary | Typically AED 7,000; a minimum salary of AED 2,000 may apply under specific conditions. |

| Nationality | It is available to both UAE citizens and foreigners. |

| Age Requirement | Must be at least 21 years old. |

How to open Fab Account Online.

How to Apply for a FAB Personal Loan with a Salary of 2000

If your minimum salary is 2000 AED, you should review the repayment alternatives and conditions before applying for a personal loan from Abu Dhabi Bank in the United Arab Emirates. To apply for the loan, you have to bring the required documents. Examine the provided process.

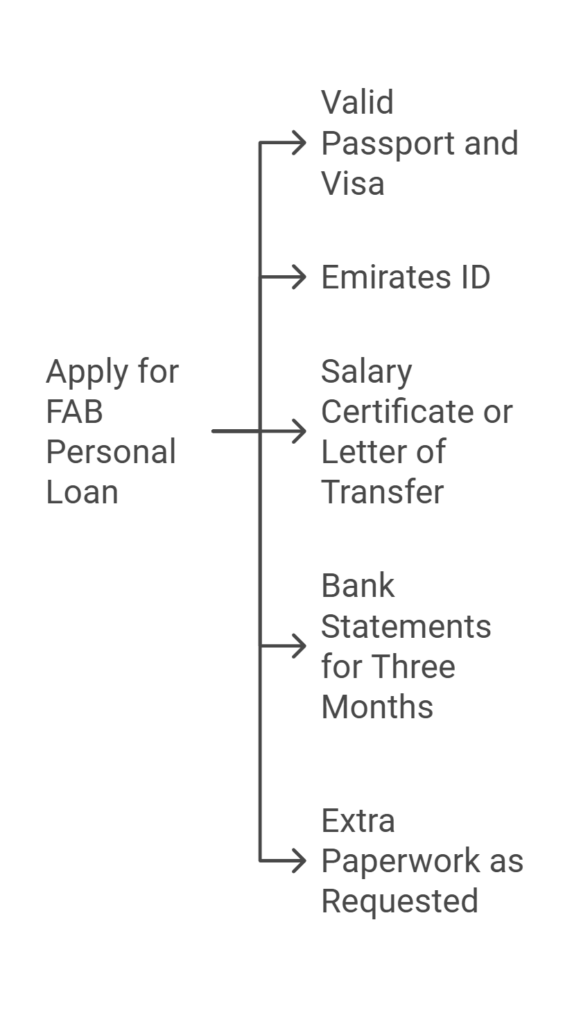

Documents Needed to Apply for a FAB Personal Loan

When applying for an FAB personal loan, applicants must have the following documents

- A copy of your valid passport and visa

- an Emirates ID

- a salary certificate, or a letter of transfer

- Bank statements for three months

- Extra paperwork as the bank requests

These documents will improve your chances of being accepted and expedite the application process.

How to get your fab account statement online.

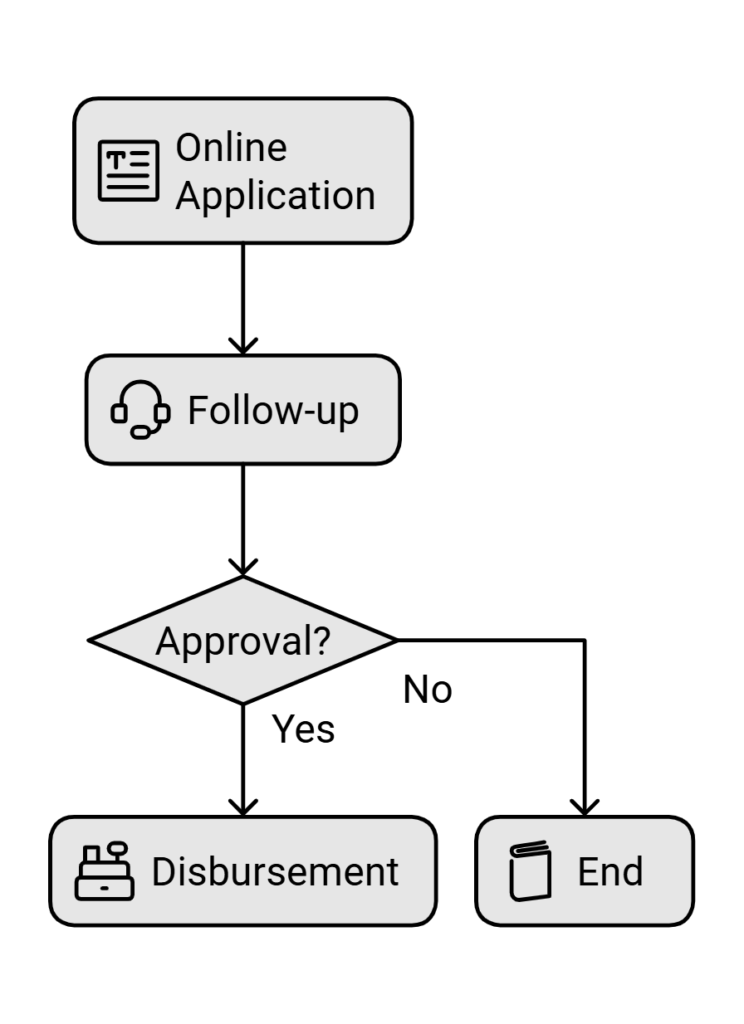

FAB Loan process step by step

The process of applying for a personal loan from FAB is simple:

Online Application

To apply for a loan, go to the FAB website, open the application area, and complete the online application. To go on to the application’s last stages, your details.

Follow-up

After your application is filed, an FAB representative will get in touch with you to go over the next stages. The interaction may entail setting up a face-to-face encounter or providing more documentation details.

Approval and Disbursement

Following approval of your application, money will be transferred into your bank account. Before taking the loan, please read the agreement carefully.

Steps to Verify Your Salary Eligibility for FAB Loans

Banks verify your income to:

- You can determine whether you can afford the loan’s monthly payments by looking at your salary.

- Larger loan amounts are typically available to those with higher incomes.

- Verification of salaries lowers the chance of defaults.

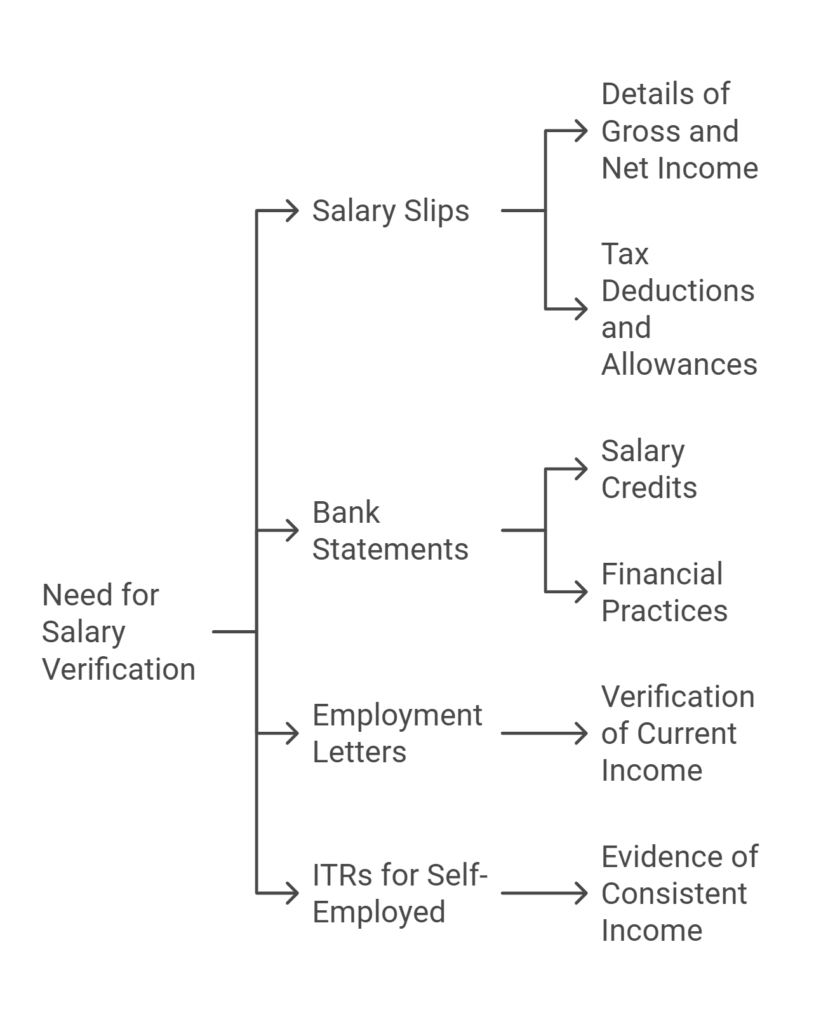

Important Documents for Verifying Salary

- Salary slips for the last three to six months are usually required by banks.

- Your gross and net income, tax deductions, and other allowances are detailed in these records.

- Your last three to twelve months’ worth of bank statements are frequently requested by banks.

- These display salary credits, which attest to your consistent income.

- Banks use the statement to evaluate your financial practices, including debt and savings.

- Banks occasionally ask for an employment or offer letter as verification of your current income, particularly for new hires.

- ITRs for the previous two to three years are frequently requested from self-employed people or those with irregular income.

- ITRs provide additional evidence of consistent income for salaried individuals.

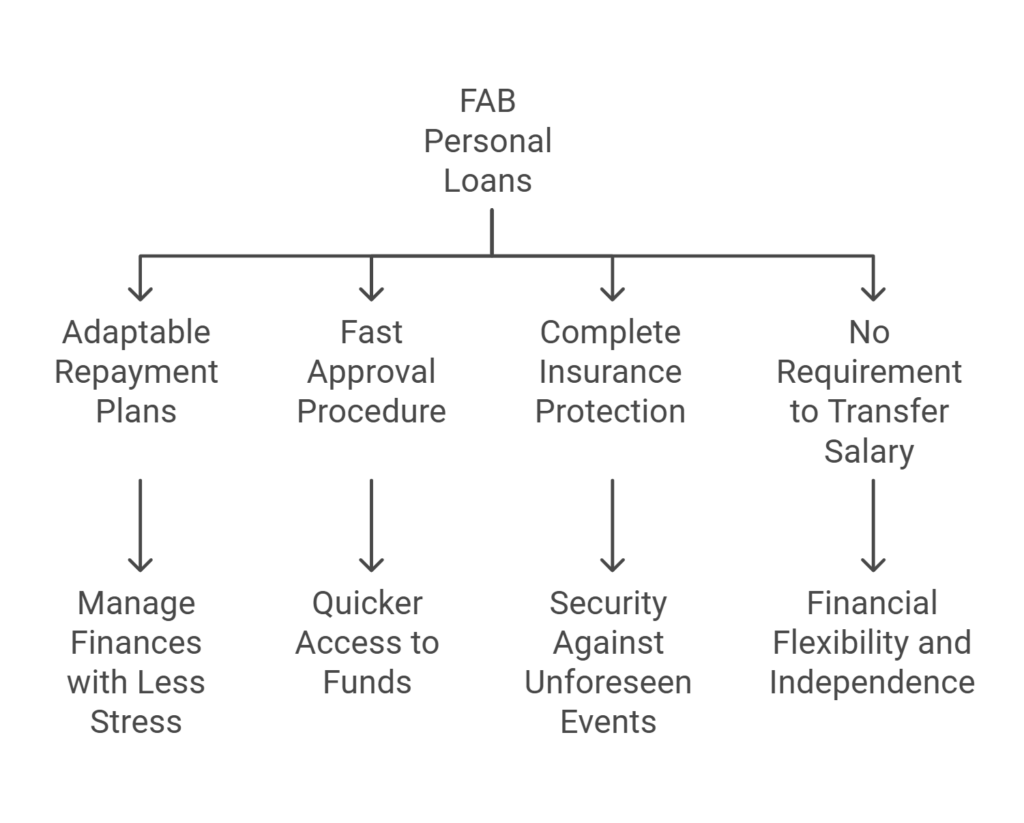

Benefits of FAB Personal Loans for Low-Income Individuals

FAB loans have several benefits

Adaptable Repayment Plans

Select terms of payment based on your financial circumstances. Because of this flexibility, borrowers can successfully manage their money without experiencing excessive stress.

Fast Approval Procedure

Because of shortened processes, anticipate quicker approvals than with traditional banks. Because of its effectiveness, you can get money when you need it most.

Complete Insurance Protection

During repayment periods, life insurance protects against unanticipated events. You can rest easy knowing that your loved ones are protected from future financial strains thanks to this function.

No Requirement to Transfer Salary

Getting a personal loan is not required, even though moving your salary to FAB might have extra advantages. You can continue to retain your financial relationships as you see fit thanks to this freedom.

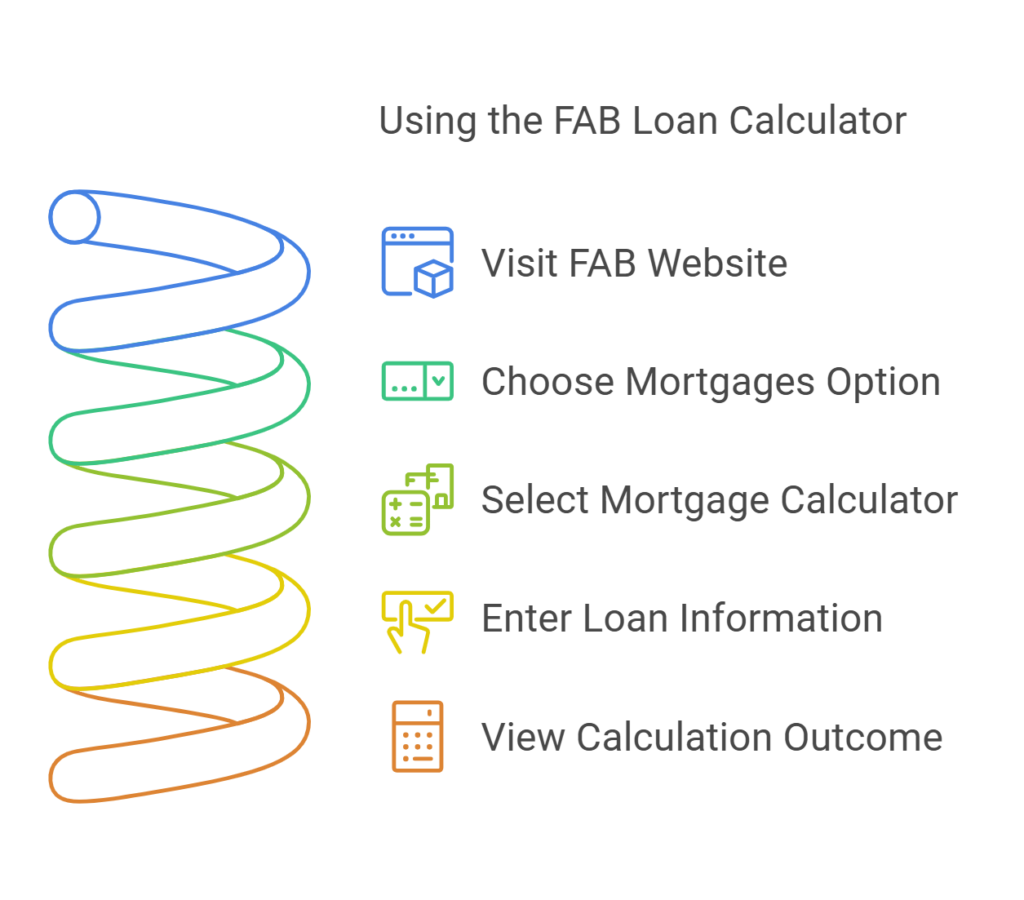

How to Use the FAB Loan Calculator for Accurate Estimates

- The FAB Home/Mortgage Loan Calculator in the United Arab Emirates can be used by

- Visit the FAB website.

- Choose the drop-down option for mortgages.

- Select the option for the Mortgage Calculator.

- Enter the required information, such as the loan amount, tenure, down payment, and property price.

- The outcome will appear at the calculator’s bottom.

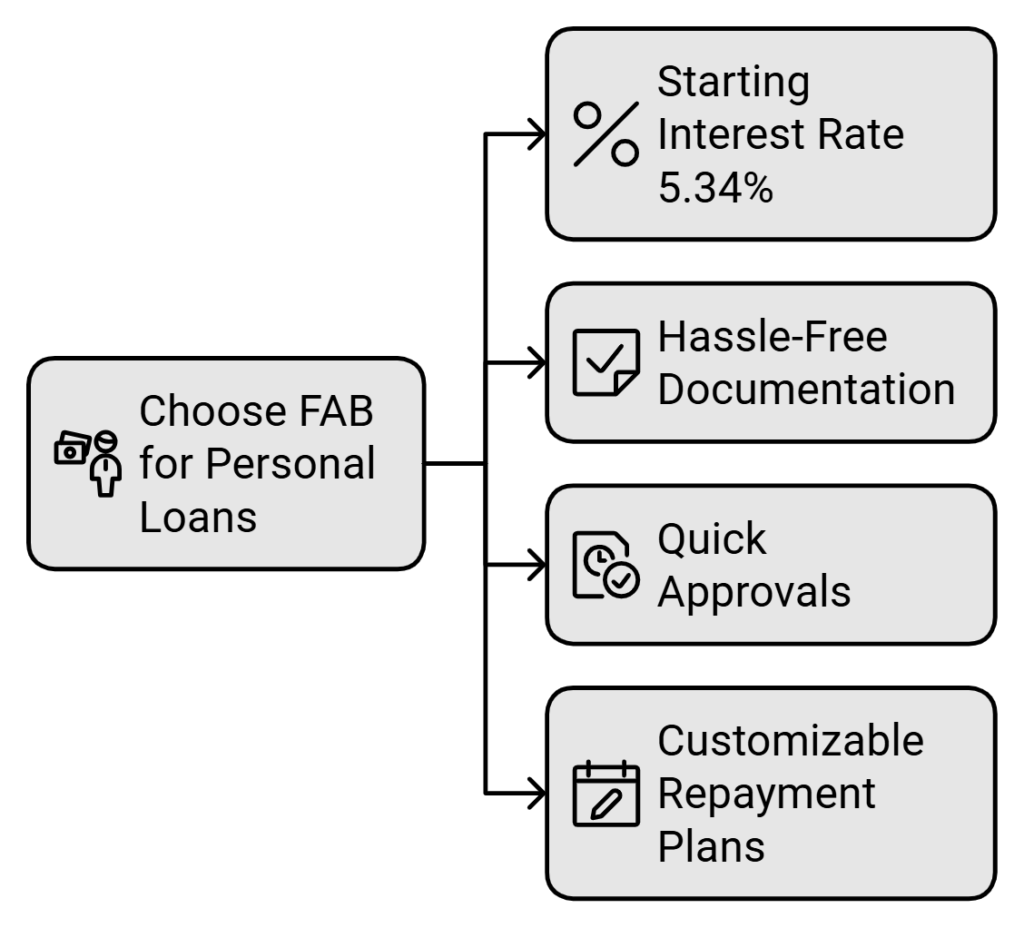

Why Choose FAB for Personal Loans?

- Important features and advantages of choosing FAB for personal loan.

- With an FAB Personal Loan, you can reach your financial objectives and take advantage of the best interest rates available, which start at 5.34% annually.

- Enjoy many advantages by applying for an FAB Personal Loan, including hassle-free documentation, quick and simple approvals, and a customizable repayment plan.

Common Challenges in Meeting Loan Eligibility Criteria and Solutions

The following are some common challenges that may make it challenging to fulfil loan qualifying requirements

Score for credit

Lenders use your credit score to assess your credit management skills and borrower reliability. Many banks require a minimum credit score for loans.

Collateral

Securing a loan can be challenging for small or startup firms since they might not have enough assets to utilize as security. Collateral may consist of valuable assets such as real estate, structures, or costly machinery.

Revenue

Lenders could be reluctant to give loans to borrowers who don’t have a reliable source of income.

History of credit

Your borrowing and repayment patterns from the past and now are reflected in your credit history. Lenders use your credit history to evaluate your borrower’s reliability and creditworthiness.

A down payment

Lenders usually demand a down payment for house loans equal to 20% of the home’s purchase price. Your application can be denied if the requisite deposit is not made.

Error in the credit report

A mistake in your credit report could lead to the denial of your loan application, even if your credit history is spotless.

Adherence to regulations

Loan officers must ensure that all loan processes comply with complex legal requirements.

Contacting FAB Customer Support for Loan Inquiries

Among our many safe and secure channels, which a separate outside provider runs, is [email protected].

The website can be accessed at fablistens.ipm.ae.starcompliance.com.

WhatsApp texting at (704) 771-0476

How To Change Mobile number in Fab Ratibi Card.

FAQs

If I don’t make the salary required for the loan, would my application be denied?

Yes, for your loan application to be authorised, your salary must match the bank’s requirements.

After the loan is accepted, how long does it take to receive the credit?

After the loan is accepted, the cash is typically credited within 3–7 days.

What is the minimum income needed to get a personal loan from FAB?

Although AED 7,000 is often the minimum pay requirement, certain goods may permit lower compensation based on particular circumstances.

If I am younger than 21, may I still apply?

No, applicants must be at least 21 years old to be eligible for a personal loan.

Does an early settlement charge apply?

Indeed, there is an early settlement cost of AED 10,500 or 1.05% of the outstanding balance, whichever is less.

What occurs if I fail to make a payment?

Fees are assessed for late payments; the minimum fee is usually 2.10% of the amount that was delayed.

How much time does it take to be accepted?

Because of FAB’s streamlined operations, approval times vary but are typically faster than those of standard banking procedures.