How to Get Your FAB Bank Statement Online: Complete Guide

Effective money management is necessary in this fast era. Online bank statements make keeping track of your transactions and account activity easy. In this article, we’ll walk you through the easy process of obtaining your Fab bank statement online via both the official website and a mobile app.

Understanding FAB Online Banking Services

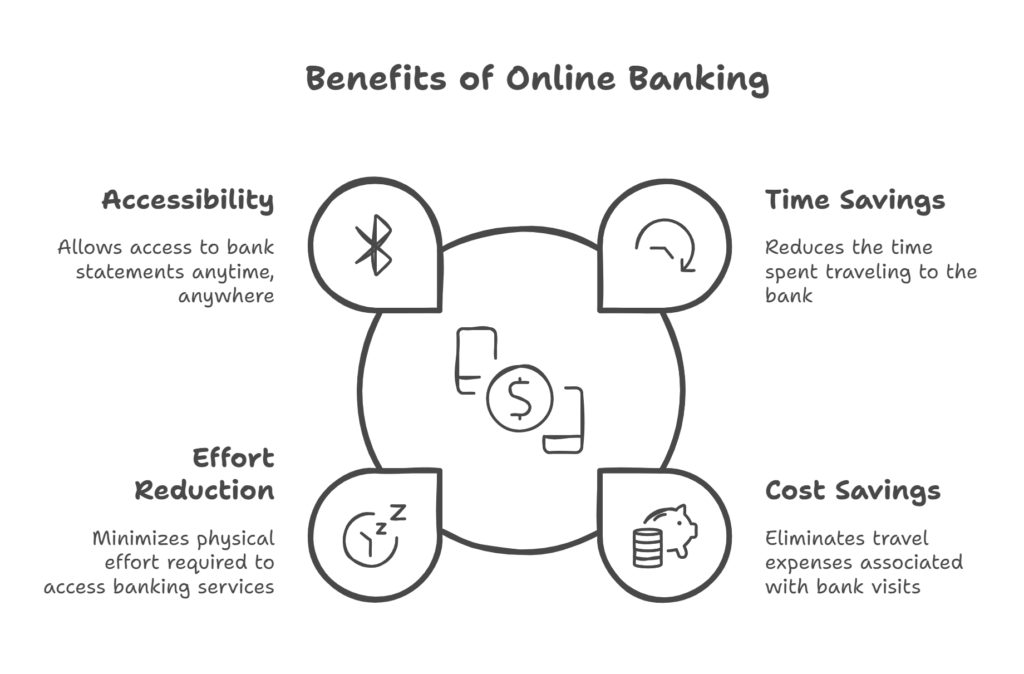

The following are some justifications for viewing the FAB bank statement online rather than requesting it in person at a bank branch:

- The first and most significant benefit is that it saves you the time, money, and effort to travel to the closest office.

- The second most significant benefit of using the online approach is the ability to check and download the statement at any moment without wasting time or waiting for hours outside the bank.

- To get the FAB bank statement online, you need only a reliable internet connection on your Android mobile or any other device.

Why is Accessing Your FAB Statement Online Convenient?

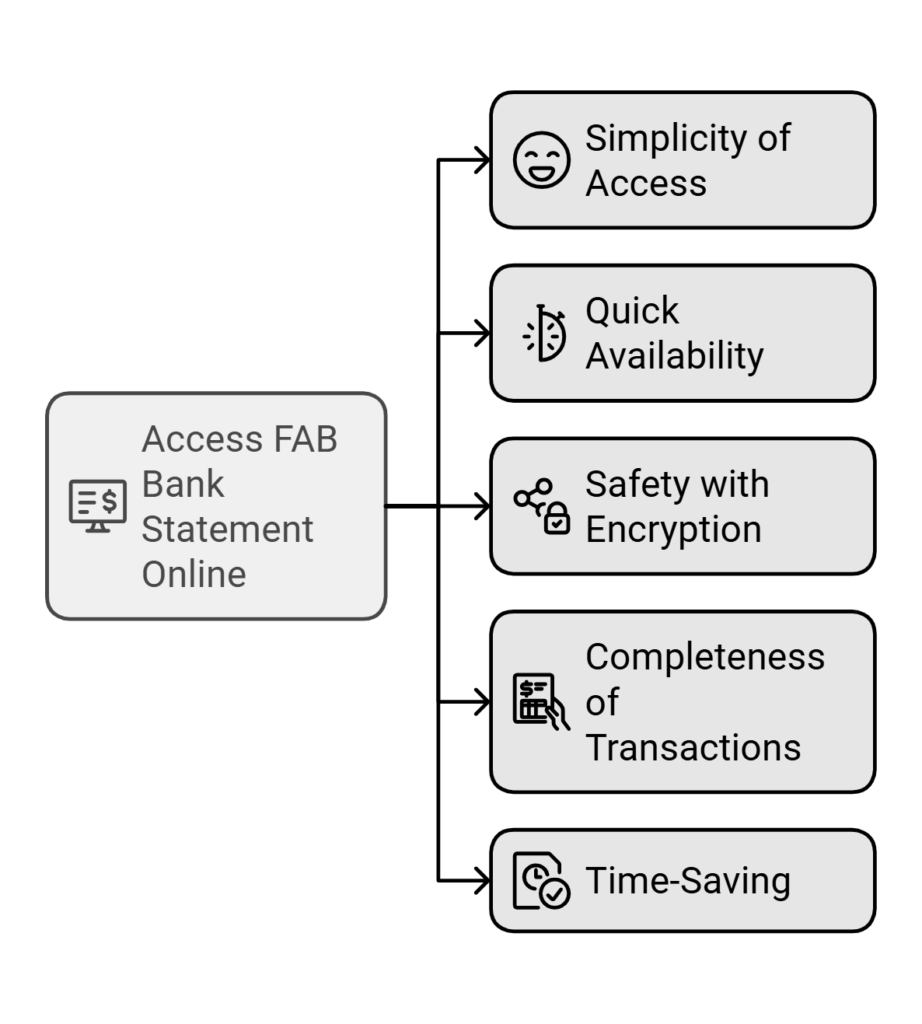

The process of getting your FAB bank statement online is simple and safe. You may download your bank statement at any time, whether you’re at home or on the go, because of digital banking. It’s convenient to view your First Abu Dhabi Bank (FAB) statement online because it’s:

Simple to get to: You can use the FAB app on your smartphone or log into your account online.

Quick: Your statement is available for download in a matter of minutes.

Safe: Your password and username are used to encrypt your statements.

Complete: All of the transactions (debits and credits) made to your account are recorded in your bank statements.

Saving time: You don’t have to wait for printed statements to come or go to a branch.

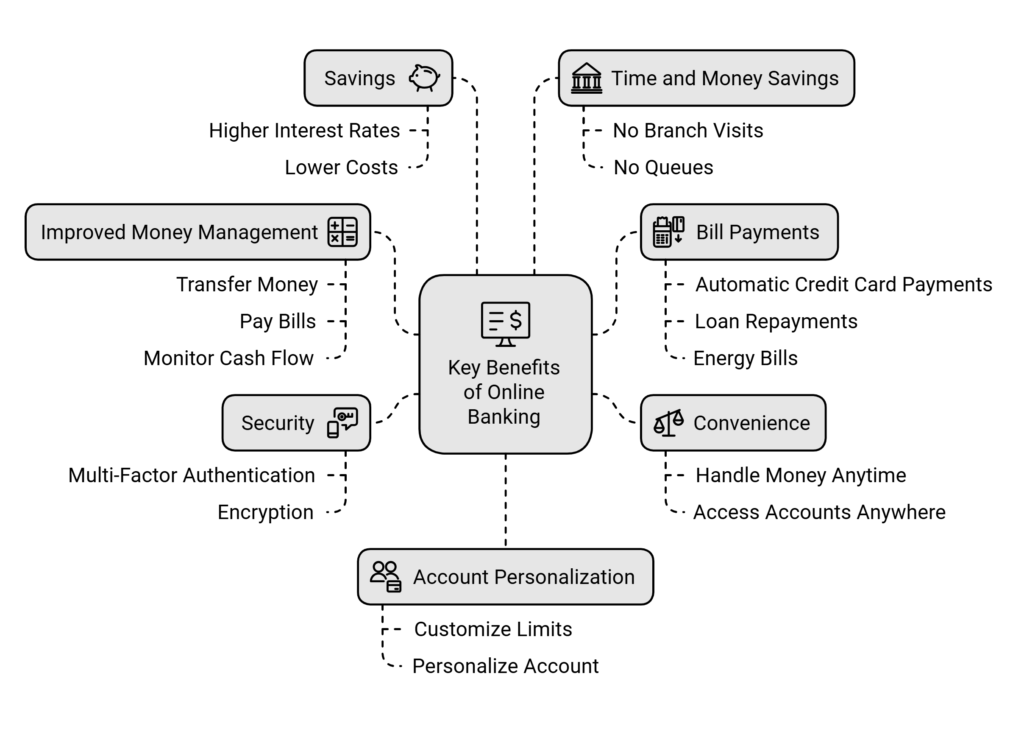

Key Benefits of Using Online Services

There are some of the online banking benefits that are following.

Convenience: You can handle your money and access your accounts at any time, any place.

Security: To safeguard your financial information, online banking systems employ multi-factor authentication and encryption.

Savings: Compared to traditional banks, online banks could provide greater interest rates and lower costs.

Savings of time and money: You don’t have to go to a branch or stand in the queue.

Improved money management: You may transfer money, pay bills, and keep an eye on your cash flow.

Account personalization: You can alter your transaction limits and personalize your account.

Setting up a budget and monitoring your expenditures are both possible.

Bill payments: Credit card payments, loan repayments, and energy bills can all be paid automatically.

Preparing to Access Your FAB Bank Statement

Documents You’ll Need

All of the transactions for a bank account during a specific period, typically a month, are presented in a bank statement. Deposits, charges, withdrawals, the starting and ending balances for the period, and any interest earned are all included in the statement.

Registering for FAB Online Banking or Mobile App

You can sign up for internet banking with First Abu Dhabi Bank (FAB) by:

Visit the website of the FAB bank.

The “Personal Online Banking (UAE)” tab should be selected.

Enter your credit or debit card number or customer ID number.

The FAB mobile app can also be used to get a bank statement and open an account.

Step-by-Step Guide Fab Account Opening Online in 2025

Step-by-step Guide to Getting Your FAB Bank Statement Online

The FAB bank statement can be seen online in two different ways. You can use either of these methods, and both are simple to put into practice: Alternative Methods to Access Your FAB Bank Statement

- According to the FAB bank website

- By FAB Mobile app

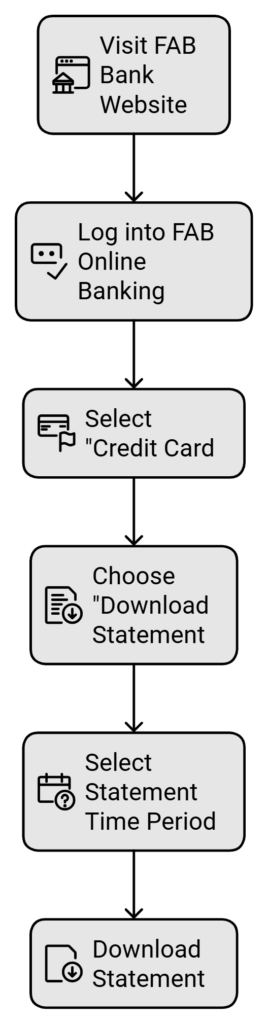

By visiting the FAB Bank official website

To obtain the FAB bank statement via the bank account, follow these steps:

Step 1: Look for the FAB bank account’s official website. After locating the link to the official website, click the log-in icon located in the upper right corner and Log into FAB Online Banking.

Step #2: You will notice several options after logging into your account. Select “Credit Card” from the menu. You can choose this option from the top bar.

Step #3: After selecting the appropriate choice, you will once again be presented with a list of possibilities. Locate and select the “Download Statement” option. after that, you also print this.

Note: The time restriction for which you wish to obtain the statement will determine whether you can download it. You can choose the one-month, two-month, one-year, or five-year statement, for instance.

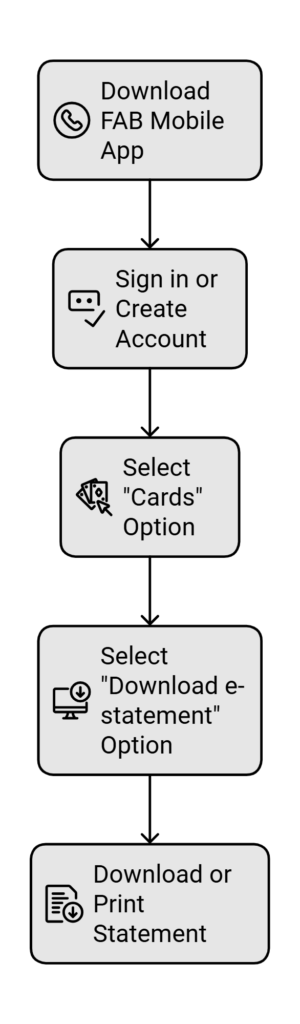

Using the FAB Mobile App

To obtain an FAB bank statement using the FAB Mobile App, follow these steps:

Step 1: Use the Apple App Store for iOS and the Google Play Store for Android to download the FAB bank app.

Step #2: After downloading the app, sign in to your account. If you don’t already have an account, you can use the app’s Sign-Up option to establish one.

Step #3: After utilizing the app to connect to your FAB account, you’ll see a number of options. Select the “Cards” option.

Step #5: Once more, a list of options will appear on the screen. Select the “Download e-statement” option to download the statement for the specified time. You can also print the statement.

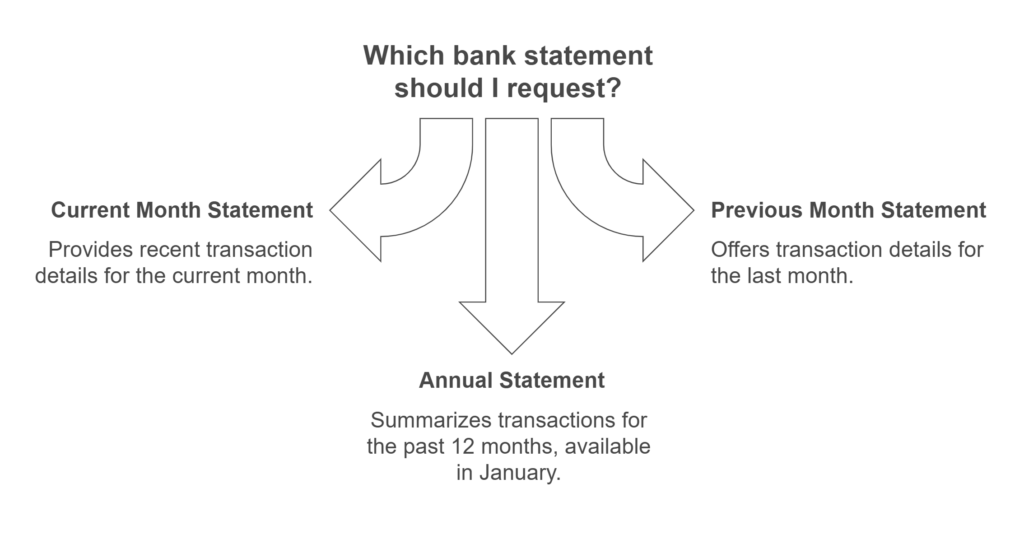

Types of bank statements

Bank statements come in three different varieties:

Statement for the Current Month: This option allows you to obtain the statement for the current month.

Statement for the Previous Month: Selecting this option will provide you with the statement for the previous month’s transactions.

Annual Statement: Selecting this option will provide you with a summary of every transaction you made throughout the previous 12 months. Please take note that this will be accessible for download during the first week of January.

Requesting Statements via FAB Customer Support

Speak with Customer Service: Contact FAB customer service at +971 2 681 1511 (international) or 600 525 500 (UAE). Visiting a FAB Branch for Physical Copies, Bring your Emirates ID and account information to the closest FAB branch for prompt assistance.

Common Issues When Accessing Bank Statements

- Problems with Account Access: Customers may find it more difficult to efficiently manage their accounts if they are unable to access mobile apps or Internet banking platforms. Frustration and the desire for more support could arise from this.

- Security Issues: Clients want to know that their financial and personal data is secure.

- Forgotten Password: The client is unable to access their online banking portal since they have forgotten their login credentials.

- Account temporarily locked: Because of suspected unauthorized activity, a customer’s account has been temporarily locked.

How to Change Mobile Number in FAB Ratibi Card

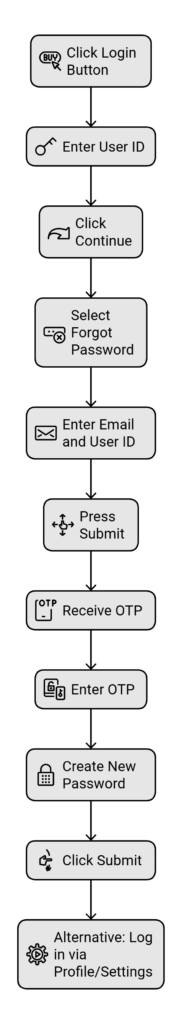

Forgotten password or user ID

You can take the following actions to get your First Abu Dhabi Bank (FAB) online banking password back

- Click the Login button in the upper right corner of the FAB website.

- Click Continue after entering your user ID.

- On the following screen, select Forgot Password.

- Enter your registered email address and user ID.

- Press the Submit button.

- Enter the One-Time Password (OTP) that was provided to register the mobile number.

- Make a new password and make sure it’s correct.

- To save your updated password, click Submit.

- Another option is to go to the profile or account settings of your bank’s official website or app, log in, and proceed with your user ID.

Technical Errors on the Website or App

- App freezing and a lost internet connection are the two biggest problems customers face with financial and mobile banking apps.

- The incapacity of applications to show transaction information or establish a direct connection with a customer support representative next.

Security Tips When Accessing Your Bank Statement Online

Ensuring Your Account’s Security and following these tips to secure your account.

- Keep a close eye on your accounts. Make sure that every transaction that appears on your accounts is one that you approve by checking them frequently.

- Don’t click on emails. You may receive email alerts and updates from your bank or other financial institution, but you are not required to click on the links to access your account.

- Change your password regularly. Make sure your password is strong and consists of a combination of capital and lowercase letters, numbers, and special characters. Don’t use the same password on several websites.

- Access your accounts from a safe location, Steer clear of using unprotected wireless networks to access the internet and access your accounts. When you are certain that your connection is secure, you should access these accounts. You

- Keep your computer safe. To protect the system from viruses that could be downloaded and installed from a rogue website, make sure your firewall is set on and that you have anti-virus software installed.

- Look for a tiny lock icon on your browser to make sure you’re logging into your bank’s website.

- Make sure your system is updated. Regardless of whether you’re accessing the Internet via a desktop or laptop, be careful to keep your system updated and download the necessary updates. Perform routine antivirus checks and approve system upgrades as required.

Frequently Asked Questions About FAB Bank Statements

Is there any fee to check the bank statement?

No, checking the FAB bank statement is free of charge. FAB bank statements are available for download at any moment.

How Often Can I Download My Statement?

You can download the first page of your bank statement by using the “E-Statement” option. Once you click on this option, the front page is the first page of the FAB bank statement.

Can I Access Old Statements Online?

Yes, the FAB bank account’s six-month statement is available for download. When downloading the statement, choose six months.

Are Online Statements Legally Recognized?

Online bank statements, however, may be acceptable and legal if your bank certifies that they are an authentic duplicate.

What is an e-statement password?

When you download your bank statement, you will be prompted to provide a password to access the information. The final four digits of your account number, along with the day and month of your birthday, will serve as this password. For instance, the password would be 12341506 if your birthday falls on June 15th and your account number ends in 1234.

Final Words: Simplify Your Banking with FAB Online Services.

Therefore, using the website and app to obtain the FAB bank statement is a simple process. Downloading the FAB bank statement is helpful not just for obtaining your transaction history but also for identifying any fraudulent transactions that may have occurred in your account. Finally, don’t hesitate to ask any questions you may have about the FAB bank.